Who should read this guide?

This guide is designed for vacation rental investment property owners who use the Guesty property management system alongside QuickBooks accounting software to manage their operations.

A vacation rental investment property is a business model in which an operator purchases a property and lists it on platforms such as Airbnb, VRBO or their own direct-booking website, with the goal of building equity more quickly than with a traditional long-term rental. This model is especially effective in markets where short-term rental income potential significantly exceeds local long-term rental rates.

However, proper accounting is essential. Strategic decisions in your accounting process can greatly influence the success of your operations. Staying closely aligned with your financial data will make a meaningful difference.

In this guide, we focus on accounting for all income received through Guesty from an investment property owner’s perspective—including how to automate Guesty revenue tracking using QuickBooks.

This guide is designed for investment property owners who use the Guesty property management system alongside QuickBooks to manage their operations.

An investment property offered as a short-term rental is a business model in which an operator purchases a property and lists it on platforms such as Airbnb, Vrbo, or their own direct-booking website, with the goal of building equity more quickly than through traditional long-term rentals. This approach is especially effective in markets where short-term rental income significantly exceeds local long-term rental rates.

However, proper accounting is critical. The decisions you make in your accounting process can directly impact the success and profitability of your operation. Staying closely aligned with your financial data enables clearer insights, stronger decision-making, and long-term sustainability.

In this guide, we focus on accounting for all income received through Guesty from an investment property owner’s perspective—including how to automate Guesty revenue tracking using QuickBooks.

NOTE: This guide only covers revenue accounting, not costs. For a guide about vacation rental costs and chart of accounts to consider, check out this guide instead: Vacation Rental Costs and Chart of Accounts to Consider

Table of Contents

Here’s what you’ll get from this guide:

- QuickBooks Chart of Accounts Template for Investment Properties on Guesty

- How to Automate Accounting for Guesty Listings

- Execute Common Transaction Workflows in QuickBooks

- Generate Monthly Reports in QuickBooks

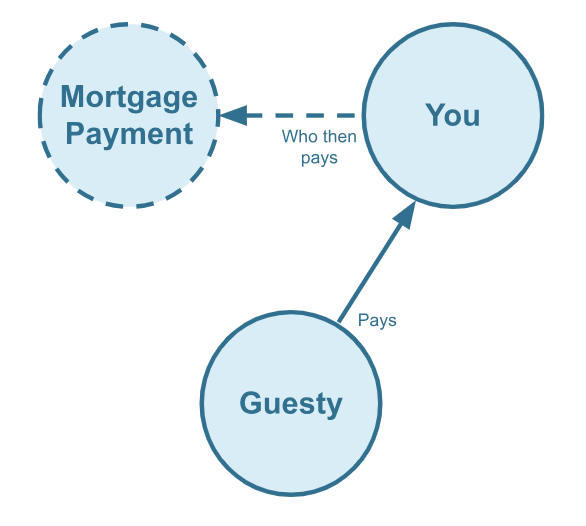

Cash Flow Diagram

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- QuickBooks for Guesty: Rental Arbitrage Accounting

- QuickBooks for Guesty: Trust Accounting for Property Managers

- QuickBooks for Guesty: Property Management without Trust Accounting

- Guesty Accounting in QuickBooks: A Comprehensive Guide

QuickBooks Chart of Accounts Template for Investment Properties on Guesty

Here we’ll describe our QuickBooks chart of accounts template for vacation rental income in great detail:

Account Codes

| No. | Account | Type |

|---|---|---|

| 24000 | Rental Liability | Liability |

| 24320 | Rental Liability: Guesty General Taxes Payable | Liability |

| 42000 | Rental Revenue | Revenue |

| 42410 | Rental Revenue: Guesty General Income – Accommodation Fare | Revenue |

| 42420 | Rental Revenue: Guesty General Income – Cleaning Fee | Revenue |

| 42430 | Rental Revenue: Guesty General Income – Additional Charges | Revenue |

| 42620 | Rental Revenue: Guesty General Refunds | Revenue |

| 51000 | Rental Costs | Cost of Service |

| 51130 | Rental Costs: Guesty General Application Fee | Cost of Service |

| 51150 | Rental Costs: Guesty General Stripe Service Fee | Cost of Service |

| 11210 | Guesty General Stripe Reserved Funds | Current Asset |

NOTE: In this guide, we only cover income accounting, not costs. For a guide about general Vacation Rental costs and chart of accounts to consider, check out this guide instead: Vacation Rental Cost Accounting and Chart of Accounts to Consider

Detailed Explanation of Accounts

Click to expand and learn more about any particular account type.

Rental Liability

24000 – Rental Liability – This is a parent account with child accounts that account for rental liabilities.

24320 – Rental Liability: Guesty General Taxes Payable – This represents all taxes collected from Guesty and payable to a tax authority.

Rental Revenue

42000 – Rental Revenue – This is a parent account with child accounts that account for rental revenue.

42410 – Rental Revenue: Guesty General Income – Accommodation Fare – This account tracks the accommodation fare portion of each Guesty reservation. The accommodation fare is equal to the number of nights multiplied by the average nightly rate of each reservation.

42420 – Rental Revenue: Guesty General Income – Cleaning Fee – This account tracks the cleaning fee portion of each Guesty reservation.

42430 – Rental Revenue: Guesty General Income – Additional Charges – This account tracks any additional charges collected from Guesty.

42620 – Rental Revenue: Guesty General Refunds – This account tracks refunds executed by Guesty.

Rental Costs

51000 – Rental Costs – This is a parent account with child accounts that account for rental costs.

51130 – Rental Costs: Guesty General Application Fee – This account tracks service fee costs from Guesty for each reservation, which is subtracted from the income.

51150 – Rental Costs: Guesty General Stripe Service Fee – This account tracks service fee costs from Stripe for each reservation, which is subtracted from the income.

11210 – Guesty General Stripe Reserved Funds – This is a current asset account that tracks amounts subtracted from Stripe as a reserve against disputes.

Accounts not included in this template

This guide primarily focuses on revenue recognition for Guesty. Please note that the provided template does not include many general accounts. We also make reference to some accounts not included in this particular template, which we’ll list here:

- 11200 – Guesty Stripe Payment Clearing Account – This account is created by Tallybreeze but is not included in this template in particular. This account is used to apply payments to Guesty invoices upon the day the Guesty reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Guesty. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in QuickBooks.

- 1XXXX – Operations Bank Account – This is your business operations bank account set up with your financial institution. It’s a cash asset account to facilitate your Vacation Rental day-to-day business operations.

- 2XXXX – Mortgage Principal – This account is a long-term liability account used to track the mortgage loan principal owed.

- 7XXXX – Mortgage Interest – This account is an expense account and is used to track the interest payments of the mortgage loan.

Quick Setup Steps

Here’s how to import the above chart of accounts template. The chart of accounts discussed in this article can be imported into QuickBooks automatically using Tallybreeze setup tools. Here’s how to access this utility…

- If you haven’t already, Sign Up to Tallybreeze. It includes free use of this template.

- Once registered, go to the Connections manager in Tallybreeze. Connect your Guesty & Stripe account, connect your QuickBooks Online account and then create a connection between the two.

- Within the Connection settings, select “Set Up QuickBooks”

- Select your business model from the drop-down list at the top and select “Import Template to QuickBooks”.

How to Automate Accounting for Guesty Listings

Guesty can generate significant revenue for many property investors. With Tallybreeze, automating the reconciliation of Guesty reservations in QuickBooks is both efficient and user-friendly. In the following section, we will outline the process for automating revenue recognition for vacation rental investment properties, including chart of accounts setup and preset configuration.

Tallybreeze Listing Presets

The Tallybreeze team has created an easy-to use interface to help you manage your Guesty listings. Once connected with QuickBooks, the system will guide users through setting up accounting rules for each listing so they can be optimized quickly and efficiently.

Explanation of Preset Lines

In this business model, everything collected from Guesty is yours. This includes the accommodation fare, cleaning fee, Guesty service fee (subtracted), any added fees, taxes and any reserved funds, etc…

| Guesty Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 100% | 42410 – Rental Revenue: Guesty General Income – Accommodation Fare |

| Cleaning Fee | 100% | 42420 – Rental Revenue: Guesty General Income – Cleaning Fee |

| Guesty Application Fee | 100% | 51130 – Rental Costs: Guesty General Application Fee |

| Guesty Stripe Fee | 100% | 51150 – Rental Costs: Guesty General Stripe Service Fee |

| Additional Charges | 100% | 42430 – Rental Revenue: Guesty General Income – Additional Charges |

| Taxes | 100% | 24320 – Rental Liability: Guesty General Taxes Payable |

| Stripe Reserved Funds | 100% | 11210 – Guesty General Stripe Reserved Funds |

Example Reservation

Let’s say you have Tallybreeze set up for this listing using the preset settings above. Let’s say Guesty sends a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $2000

- Cleaning Fee: $300

- Guesty Application Fee: -$60

- Transient Occupancy Taxes: $200

- Reservation Total: $2440

Tallybreeze accounts for all the income received by Guesty, separating out each price item. The total amount to be received from Guesty for this reservation is $2440, which is allocated to the Guesty Payment Clearing Account to be later reconciled against the resulting bank deposit.

| Account | Debit | Credit |

|---|---|---|

| 42410 – Rental Revenue: Guesty General Income – Accommodation Fare | $2000 | |

| 42420 – Rental Revenue: Guesty General Income – Cleaning Fee | $300 | |

| 51130 – Rental Costs: Guesty General Application Fee | $60 | |

| 24320 – Rental Liability: Guesty General Taxes Payable | $200 | |

| 11200 – Guesty Stripe Payment Clearing Account (Asset) | $2440 |

On the date the reservation payout is received from Guesty into your Operations Bank Account (3-5 days later), a bank rule in QuickBooks can automatically reconcile the amount back to the Guesty Stripe Payment Clearing Account:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Operations Bank Account | $2440 | |

| 11200 – Guesty Stripe Payment Clearing Account (Asset) | $2440 |

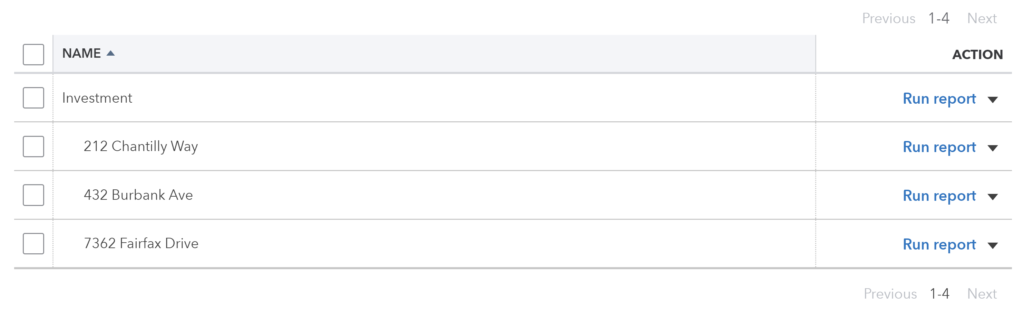

Set Invoice Customer & Class Categories

Finally, consider setting up a general customer (e.g. “Guesty Guests”) in your Tallybreeze listing rules. Or if you prefer, you can also set the guest as the customer if you want to save your guest information in QuickBooks. It’s also a good idea to set the class category of each line item as “Investment: <Listing Address>” meaning you should create two class categories in QuickBooks for this listing, one class category is “Investment” (set as the parent class) and the other class is the sub-class that represents the specific listing address. See example below:

Automate Additional Bills & Invoices (Optional)

With Tallybreeze, you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set amounts payable to a tax authority for each reservation.

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze’s presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

- Select your business model from the options.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Execute Common Transaction Workflows in QuickBooks

In this section, we explore the nuances of vacation rental investment property transactions. The most common workflows for investors are outlined below:

Making a Mortgage Payment

A common transaction workflow to identify is paying your mortgage, which includes a principal amount plus interest.

Example Transaction

You, the vacation rental investor, are making a mortgage payment in the amount of $2000, whereas $500 of which is considered interest. This is for the property located at 212 Chantilly Way through a recurring bank transaction which happens monthly. Once the transfer is posted and complete, reconcile the outgoing transaction from the Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $2,000 | Investment: 212 Chantilly Way | |

| 2XXXX – Mortgage Principal | $1,500 | Investment: 212 Chantilly Way | |

| 7XXXX – Mortgage Interest | $500 | Investment: 212 Chantilly Way |

Detailed instructions for QuickBooks Online

1. Create a Recurring Bill

| Vendor | Category | Description | Amount | Class |

|---|---|---|---|---|

| Mortgage Company | 2XXXX – Mortgage Principal | “Mortgage Principal Payment” | $1,500 | Investment: 212 Chantilly Way |

| Mortgage Company | 7XXXX – Mortgage Interest | “Mortgage Interest Payment” | $500 | Investment: 212 Chantilly Way |

2. Pay the Bill

Pay the Bill directly in QuickBooks or reconcile the Bill against the payment made in your bank feed.

Remitting Custom Taxes

In most jurisdictions, operators are required to collect transient occupancy taxes and remit them to the appropriate local tax authorities. Typically, vacation rental investors receive these taxes through Guesty and are responsible for submitting the payments directly to the relevant agency.

If you are using Tallybreeze, the “Taxes” line item within your presets is designed to automatically handle the tax collection process. As a result, your responsibility is simply to remit the collected amounts to the proper tax authority.

This guide will walk you through the process in detail.

Example

The listing, 462 Atlas Way, is set up on Guesty to receive custom taxes for all reservations. In Tallybreeze, these amounts are allocated to “24320 – Rental Liability: Guesty General Taxes Payable”. After running a balance sheet report on this listing in QuickBooks, you see that $200 is owed for transient occupancy taxes.

First, you’ll need to send your payment to the tax authority either via bank transfer, ACH, check or other means. Once the transaction is posted and complete, record the outgoing transaction from the Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $200 | Investment: 462 Atlas Way | |

| 24320 – Rental Liability: Guesty General Taxes Payable | $200 | Investment: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. Check how much exists in the Custom Taxes Payable account for the property

The amount that needs to be paid to the tax authority can be found in the balance sheet. Filtering the balance sheet by the class for each listing, look up the total amount under “24320 – Rental Liability: Guesty General Taxes Payable”.

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Tax Authority | 24320 – Rental Liability: Guesty General Taxes Payable | “Taxes Paid: 11% City TOT” | Investment: 462 Atlas Way |

- Set the vendor of the bill to the name of the tax authority

- Set the Product/Service to “24320 – Rental Liability: Guesty General Taxes Payable”

- Set a detailed description, starting with “Taxes: ” and describe the tax

- Set the class to the listing

3. Transfer the amount from your operations bank account to the tax authority

Send the money via bank transfer, ACH, check or other means.

4. Reconcile operations bank account statement line amount with bill

Reconcile the bill with the bank feed in QuickBooks

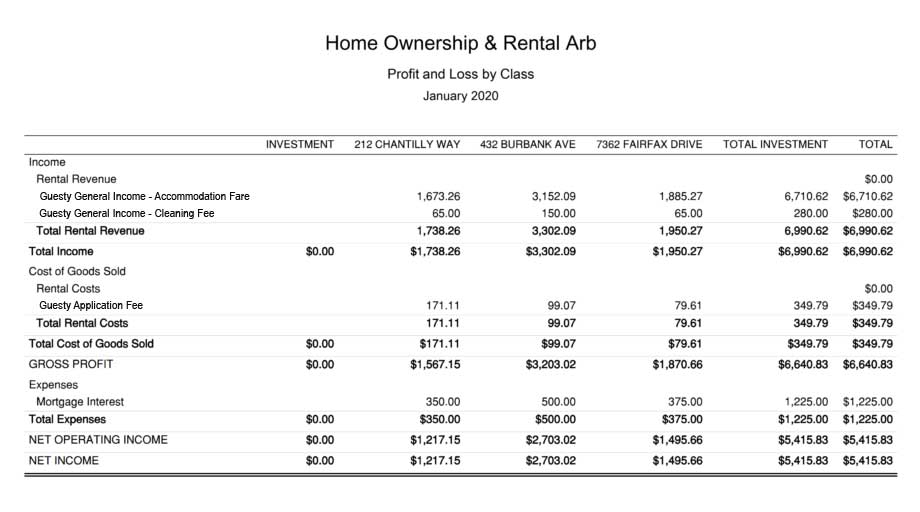

Generate Monthly Reports in QuickBooks

Now that your reservation data is automatically processed from Guesty and perfectly synced into QuickBooks, you’ll be able to produce beautiful monthly reports of your vacation rental investments. After you’ve reconciled any expenses, you can then observe the performance of each listing in detail.

Profit & Loss by Class

This report is meant for internal purposes to view side-by-side, displaying the profitability of each listing for your vacation rental investment operations. This report is found under QuickBooks “Reports” as “Profit and Loss by Class”:

Conclusion

In the right market and location, listing your property across multiple channels using Guesty can be an excellent way to accelerate equity growth in your investment portfolio. The accounting approach outlined in this article offers valuable transparency into the performance of your vacation rental operations and supports more informed financial decision-making.

We hope this guide has provided meaningful insight as you continue building your real estate portfolio. But remember—successful investing requires more than strong demand and good listings. You also need a reliable system for tracking your financials and a clear accounting process that keeps your business stable, even when one property underperforms. In vacation rental investing, numbers are everything. If you’re ready to automate your Guesty-based accounting workflows and strengthen the financial foundation of your operations, explore our software to get started.

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out: