Who should read this guide?

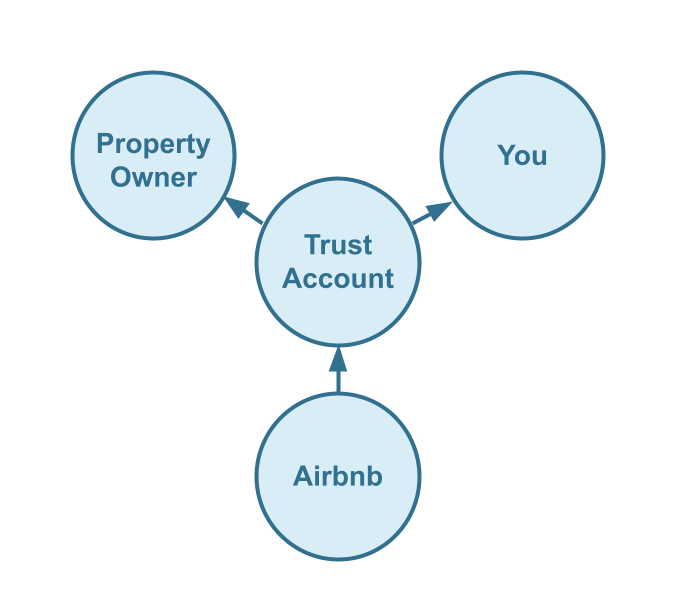

This article explains how to automate Trust Accounting for property managers handling Airbnb listings in Xero and outlines the key workflows used to collect funds from Airbnb on behalf of owners through a trust account. It serves as a solid starting point for property managers who must comply with state or local trust accounting requirements. In this context, a trust account is a bank account established with a financial institution and used by real estate brokers or licensed property managers to hold and manage client funds.

For the purposes of this guide, we assume that you are using Xero and that all funds collected through Airbnb are deposited directly into your trust bank account. We also assume you maintain a separate bank account for your own business operating expenses.

USING QUICKBOOKS? READ THIS ARTICLE INSTEAD

NOTE: We only cover income accounting in this guide, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide: Accounting for Costs to Operate Airbnb Listings: Best Chart of Accounts

Table of Contents

What you’ll get from this guide:

- Xero Chart of Accounts Template for Trust Accounting of Airbnb Properties

- How to Automate Trust Accounting for Airbnb Listings

- Execute Common Transaction Workflows in Xero

- Generate monthly owner statements and reports for your clients

Cash Flow Diagram

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- Xero for Airbnb Listings: Property Management without Trust Accounting

- Xero for Airbnb Listings: Co-Host Accounting

- Xero for Airbnb Listings: Rental Arbitrage Accounting

- Xero for Airbnb Listings: Investment Property Accounting

- All Xero Templates for Airbnb

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

Trust Accounting vs Accounting for your Business

What is fiduciary duty? Fiduciary duty is a legal obligation requiring you to act in the best interest of another person or organization. In the context of trust accounting, property managers have a fiduciary responsibility when handling owner funds within a trust account. This responsibility includes maintaining accurate, auditable records to ensure complete transparency in how owner funds are used.

Many jurisdictions impose specific rules for managing and reporting on trust accounts. However, even if your state does not require formal trust accounting, it is still wise to follow these best practices. Trust accounting creates transparency – and owners greatly value transparency.

When operating a business that uses a trust account, you are effectively managing two sets of books:

- Accounting for the Trust Account, which tracks owner funds.

- Accounting for your Property Management Business, which tracks your operational income and expenses.

Three-Way Trust Reconciliation for Trust Accounting

The proper reconciliation process for trust accounting of Airbnb listings is known as the three-way trust reconciliation. This process requires three separate records to match exactly: the trust ledger, the stakeholder ledgers, and the trust bank statement (Source). Each of these balances must agree in order to complete a proper reconciliation.

- The trust ledger: This is a ledger of all the transactions of the trust account, which will be recorded in Xero. In our chart of accounts template, the trust ledger is the sum of all accounts that start with the words “Trust Account Liability” (all codes starting with 23xxxx).

- The stakeholder ledgers: The stakeholder ledgers are created by taking the trust ledger a step further, assigning each transaction to a specific stakeholder and grouping together all the trust account activity associated with each individual stakeholder. In our chart of accounts template, under our trust ledger (Trust Account Liability), we separate two primary stakeholders, Owner Funds and Property Mgmt Funds. We’ll also make use of tracking categories in Xero to further separate funds between each of our owners.

- The trust bank statement: This is generated by the bank where the trust account is held and it provides third party verification of the transactions posted to the trust account.

During reconciliation, the trust bank statement balance should match both the trust ledger and the sum of all stakeholder ledger balances – this is the reason it’s called “three-way reconciliation.”

Accounting for your Property Mangement Business

In addition to reconciling the trust ledger and each stakeholder ledger, the property manager must also reconcile their own company ledgers. Property management funds are first held in the trust account and later transferred from the trust bank account to the property manager’s operating bank account. For this reason, our template includes three main sections: Trust Account Assets, Trust Account Liabilities, and Property Mgmt Revenues. These correspond as follows:

- Trust Account Assets: This is the sum of accounts that start with “Trust Account Asset”, which tracks what’s owed to the property management company from the trust account and should always match the Property Mgmt Funds total within Trust Account Liability.

- Trust Account Liabilities: This is the trust ledger discussed above.

- Property Mgmt Revenues: This keeps track of all earnings of the property management company derived from the trust account.

Xero Chart of Accounts Template for Trust Accounting of Airbnb Listings

Here we’ll explain the chart of accounts template provided by Tallybreeze in great detail.

Account Codes

| No. | Account | Type |

|---|---|---|

| 12100 | Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Reserved | Asset |

| 12200 | Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable | Asset |

| 23120 | Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Reserved | Liability |

| 23140 | Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable | Liability |

| 23310 | Trust Account Liability – Owner Funds – Owner Funds Reserved | Liability |

| 23330 | Trust Account Liability – Owner Funds – Airbnb Collections – Accommodation Fare | Liability |

| 23340 | Trust Account Liability – Owner Funds – Airbnb Collections – Cleaning Fees | Liability |

| 23350 | Trust Account Liability – Owner Funds – Airbnb Collections – Resolution Adjustments | Liability |

| 23360 | Trust Account Liability – Owner Funds – Airbnb Collections – Airbnb Service Fees | Liability |

| 23370 | Trust Account Liability – Owner Funds – Airbnb Collections – Refunds | Liability |

| 23380 | Trust Account Liability – Owner Funds – Airbnb Collections – Custom Taxes Payable | Liability |

| 23390 | Trust Account Liability – Owner Funds – Airbnb Collections – Tax Withholdings | Liability |

| 23400 | Trust Account Liability – Owner Funds – Airbnb Collections – Airbnb Suspense Account | Liability |

| 23500 | Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt | Liability |

| 23600 | Trust Account Liability – Owner Funds – Less Owner Payouts | Liability |

| 41100 | Property Mgmt Revenue – Airbnb Commissions | Revenue |

| 41200 | Property Mgmt Revenue – Airbnb Cleaning Fees | Revenue |

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Detailed Explanation of Accounts

Click to expand and learn more about any particular account.

Trust Account Assets

12100 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Reserved – This account balance should always match “23120 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Reserved”. This account tracks amounts allocated to the property management company in the trust account but are held in reserve within the trust account for funding any issues needing to be paid by the property management company. For example, if you provide a refund to a guest because of something at the fault of the property management company (e.g. to reimburse on a complaint for an unclean listing), this amount should be paid out of the property management company portion of the trust account.

12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable – This account balance should always match “23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable”. This account tracks amounts due to the property management company from the trust account.

Trust Account Liabilities

23120 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Reserved – This account balance should always match “12100 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Reserved”. This account tracks amounts allocated to the property management company in the trust account but are held in reserve within the trust account for funding any issues needing to be paid by the property management company. For example, if you provide a refund to a guest because of something at the fault of the property management company (e.g. to reimburse on a complaint for an unclean listing), this amount should be paid out of the property management company portion of the trust account.

23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable – This account balance should always match “12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable”. This account tracks amounts due to the property management company from the trust account.

23310 – Trust Account Liability – Owner Funds – Owner Funds Reserved – This account tracks amounts allocated to owners in the trust account held in reserve. Rather than being paid out to owners, these amounts are held for funding property maintenance from the trust account.

23330 – Trust Account Liability – Owner Funds – Airbnb Collections – Accommodation Fare – This account tracks the accommodation fare portion of each Airbnb reservation. The accommodation fare is equal to the number of nights multiplied by the average nightly rate of each reservation.

23340 – Trust Account Liability – Owner Funds – Airbnb Collections – Cleaning Fees – This account tracks the cleaning fee portion of each Airbnb reservation.

23350 – Trust Account Liability – Owner Funds – Airbnb Collections – Resolution Adjustments – This account tracks any resolution adjustments collected from Airbnb.

23360 – Trust Account Liability – Owner Funds – Airbnb Collections – Airbnb Service Fees – This account tracks service fee costs from Airbnb for each reservation, which is subtracted from Airbnb collections.

23370 – Trust Account Liability – Owner Funds – Airbnb Collections – Refunds – This account tracks refunds executed by Airbnb, which is subtracted from Airbnb collections.

23380 – Trust Account Liability – Owner Funds – Airbnb Collections – Custom Taxes Payable – This account tracks any custom taxes collected from Airbnb and payable to a tax authority from the trust account.

23390 – Trust Account Liability – Owner Funds – Airbnb Collections – Tax Withholdings – This account tracks any taxes withheld by Airbnb for income tax obligations. This is very rare and usually due to the Airbnb account holder lacking tax identification information. Ideally, this account should not contain any balance and is seldom (if ever) used. To avoid income tax withholdings from Airbnb, be sure to update your Airbnb account with your tax identification information and verify your account.

23400 – Trust Account Liability – Owner Funds – Airbnb Collections – Airbnb Suspense Account – This account tracks any income or refund events from Airbnb not tied to any particular reservation or listing. For example, on rare occasions if you receive a credit from Airbnb for referring another host or if you purchase photography from Airbnb. When there’s no associated reservation related to the transaction, there’s no particular listing rules to handle the amounts in Tallybreeze.

23500 – Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt – This account tracks any amounts subtracted from the owner’s portion of the trust account to pay the property management company.

23600 – Trust Account Liability – Owner Funds – Less Owner Payouts – This account tracks any amounts subtracted from the owner’s portion of the trust account to pay the owners.

Property Mgmt Revenues

41100 – Property Mgmt Revenue – Airbnb Commissions – This account tracks Airbnb commissions earned by the property management company.

41200 – Property Mgmt Revenue – Airbnb Cleaning Fees – This account tracks Airbnb cleaning fees earned by the property management company.

Accounts not included in this template

For the scope of this guide, we’re mainly focused on Airbnb revenue recognition and movements within the trust account. It is important to point out that our template does not include many general accounts. We also make reference to some accounts not include in this particular template, which we’ll list here:

- 11000 – Airbnb Payment Clearing Account – This account is created by Tallybreeze but is not included in this template in particular. This account is used to apply payments to Airbnb invoices upon the day the Airbnb reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Airbnb. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in Xero.

- 1XXXX – Trust Bank Account – This is a bank account set up with your financial institution for funds held in trust. It’s a cash asset account solely for the management of owner funds as part of the three-way reconciliation process.

- 1XXXX – Operations Bank Account – This is a separate bank account set up with your financial institution. It’s a cash asset account to facilitate your property management company’s day-to-day business operations.

- 4XXXX – Billable Expenses Income – This is a general account for capturing income received for the payment of billable expenses by owners, which may include a markup.

- 7XXXX – Billable Expenses – This is a general account for tracking billable expenses for any owners.

Quick Setup Steps

Here’s how to import the above chart of accounts template. All of the accounts discussed in this article can be imported into Xero automatically using Tallybreeze’s setup tools. Here’s how to access this utility:

- If you haven’t already, Sign Up to Tallybreeze. It includes free use of this template.

- Once registered, go to the Connections manager in Tallybreeze. Connect your Airbnb account, connect your Xero account and then create a connection between the two.

- Within the Connection settings, select “Set Up Xero”

How to Automate Trust Accounting for Airbnb Listings

Tallybreeze is a powerful tool that helps property managers track all monies collected by Airbnb. It reconciles all reservations automatically and in great detail, making it easy for you to keep track of trust funds and commissions. Additionally, Tallybreeze offers presets so property managers can use trust accounting practices right out of the box. In this section we’ll discuss step-by-step how to set up a seamless automation using the chart of accounts above.

Tallybreeze establishes a connection between any number of Airbnb and Xero accounts, which therein processes accounting data for each reservation. Here you’ll set specific accounting rules for each listing. When reservations are detected, Tallybreeze can generate invoices automatically in Xero with all allocations processed to the trust account, including Airbnb collections, property management commissions, cleaning fee allocations and any other split needed.

Tallybreeze Listing Presets for Airbnb Trust Accounting

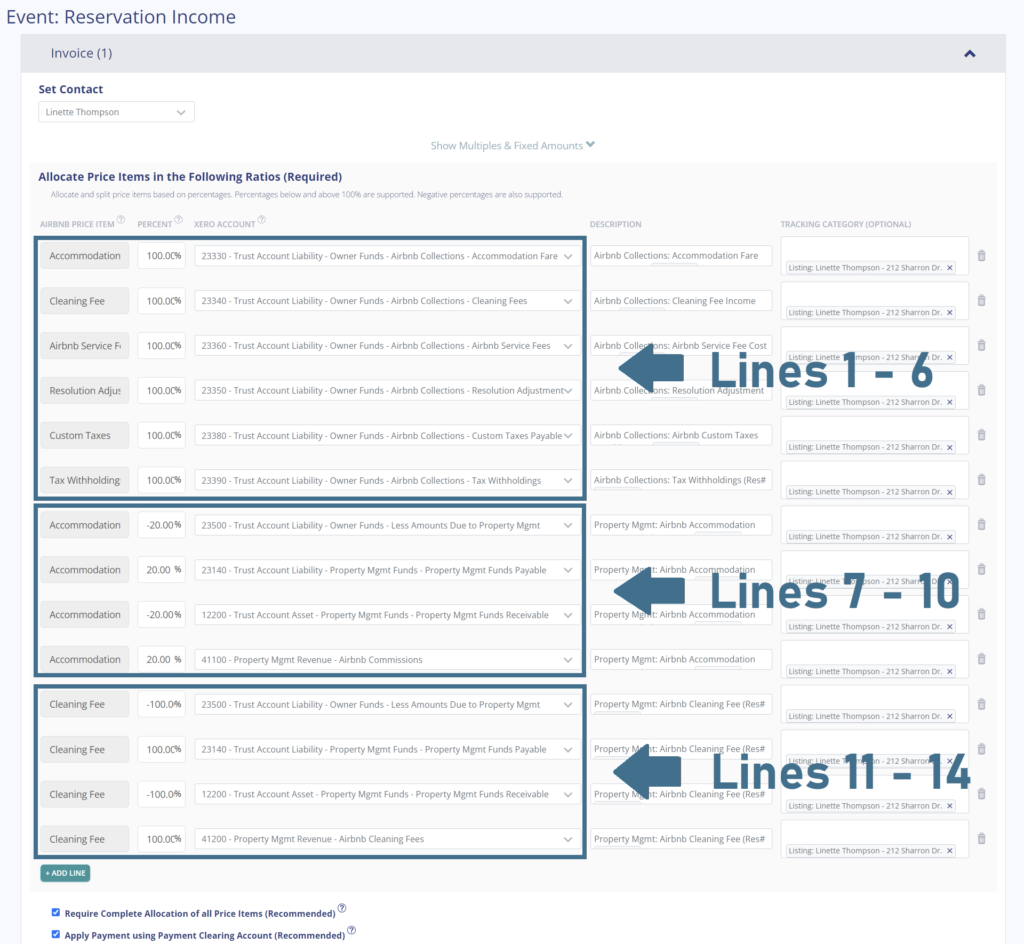

Tallybreeze makes it easy to manage your Airbnb listings on Xero. Once your accounts are connected, you’ll be guided through setting up trust accounting rules for each listing in just a few clicks. Using the presets from our template, you can get started quickly and customize them as needed. These presets are organized into three groups: Lines 1–6, Lines 7–10, and Lines 11–14.

Explanation of Preset Lines

Click to expand and learn more about each preset.

Lines 1-6: All amounts received by Airbnb are 100% allocated to the owner in the trust account

This group of lines allocates 100% of all income from Airbnb to the owner within the Trust Account Liability under Airbnb Collections. This includes the accommodation fare, cleaning fee, Airbnb service fee (subtracted), any resolution adjustments, custom taxes (optional) and tax withholdings (if they exist)

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 100% | 23330 – Trust Account Liability – Owner Funds – Airbnb Collections – Accommodation Fare |

| Cleaning Fee | 100% | 23340 – Trust Account Liability – Owner Funds – Airbnb Collections – Cleaning Fees |

| Airbnb Service Fee | 100% | 23360 – Trust Account Liability – Owner Funds – Airbnb Collections – Airbnb Service Fees |

| Resolution Adjustment | 100% | 23350 – Trust Account Liability – Owner Funds – Airbnb Collections – Resolution Adjustments |

| Custom Taxes | 100% | 23380 – Trust Account Liability – Owner Funds – Airbnb Collections – Custom Taxes Payable |

| Tax Withholdings | 100% | 23390 – Trust Account Liability – Owner Funds – Airbnb Collections – Tax Withholdings |

Lines 7-10: A 20% commission is received from the owner to the property manager

This group of lines transfers 20% of the accommodation fare out of the owner funds of the trust account and allocates it to the property manager.

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | -20% | 23500 – Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt |

| Accommodation Fare | 20% | 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable |

| Accommodation Fare | -20% | 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable |

| Accommodation Fare | 20% | 41100 – Property Mgmt Revenue – Airbnb Commissions |

Lines 11-14: The entire Airbnb cleaning fee is received from the owner to the property manager

This group of lines transfers 100% of the cleaning fee out of the owner funds of the trust account and allocates it entirely to the property manager.

| Airbnb Price Item | % | Account |

|---|---|---|

| Cleaning Fee | -100% | 23500 – Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt |

| Cleaning Fee | 100% | 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable |

| Cleaning Fee | -100% | 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable |

| Cleaning Fee | 100% | 41200 – Property Mgmt Revenue – Airbnb Cleaning Fees |

Example Reservation

Suppose you have Tallybreeze configured for this listing using the preset settings above. Now imagine Airbnb issues a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $1500

- Cleaning Fee: $200

- Airbnb Service Fee: -$50

- Airbnb Transient Occupancy Taxes: $250

- Reservation Total: $1900

First, Tallybreeze records all income received from Airbnb, separating each price item accordingly. The total amount due from Airbnb for this reservation is $1,900, which is posted to the Airbnb Payment Clearing Account and later reconciled with the corresponding bank deposit.

| Account | Debit | Credit |

|---|---|---|

| 23330 – Trust Account Liability – Owner Funds – Airbnb Collections – Accommodation Fare | $1500 | |

| 23340 – Trust Account Liability – Owner Funds – Airbnb Collections – Cleaning Fees | $200 | |

| 23360 – Trust Account Liability – Owner Funds – Airbnb Collections – Airbnb Service Fees | $50 | |

| 23380 – Trust Account Liability – Owner Funds – Airbnb Collections – Custom Taxes Payable | $250 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $1900 |

Next, within the same invoice, Tallybreeze calculates 20% of the Accommodation Fare ($1,500 × 20% = $300), reallocates this amount as payable from the trust account, and records it as earnings receivable by the property management company:

| Account | Debit | Credit |

|---|---|---|

| 23500 – Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt | $300 | |

| 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable | $300 | |

| 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable | $300 | |

| 41100 – Property Mgmt Revenue – Airbnb Commissions | $300 |

Then, within the same invoice, Tallybreeze takes 100% of the Cleaning Fee ($200), reallocates this amount as payable from the trust account and records it as earnings receivable by the property management company:

| Account | Debit | Credit |

|---|---|---|

| 23500 – Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt | $200 | |

| 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable | $200 | |

| 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable | $200 | |

| 41200 – Property Mgmt Revenue – Airbnb Cleaning Fees | $200 |

Finally, on the date the reservation payout is received from Airbnb into the Trust Bank Account (3-5 days later), a bank rule in Xero can automatically reconcile the amount back to the Airbnb Payment Clearing Account:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Trust Bank Account | $1900 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $1900 |

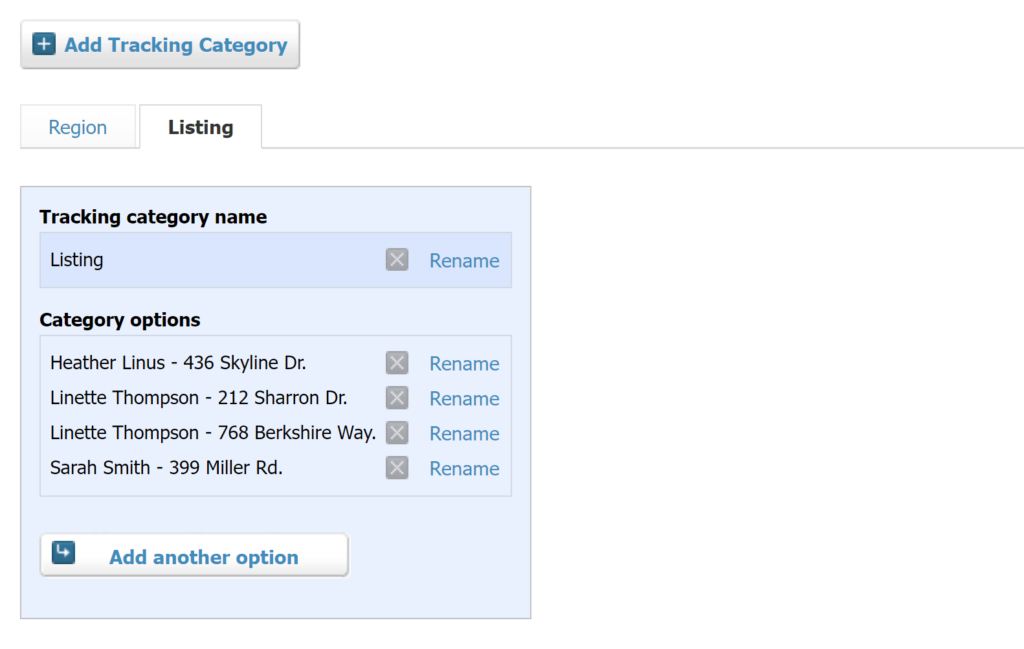

Set Invoice Contact & Tracking Categories

In Tallybreeze, you can configure a contact for each invoice within your listing rules. For property managers, we generally recommend setting the property owner as the contact. For tracking categories, it’s helpful to assign both the owner and the listing address to keep reporting organized. The example below illustrates this setup:

Automate Additional Bills & Invoices (Optional)

With Tallybreeze, you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set payouts payable to the property owner for each reservation.

- Create a bill to set amounts payable to a tax authority for each reservation.

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Execute Common Transaction Workflows in Xero

In this section, we describe the common transaction workflows that take place in Xero, as needed for Airbnb trust accounting and property management.

Paying the Property Manager from the Trust Account

Commissions have accumulated, and it’s time to pay yourself—the property manager—from the Trust Bank Account. Once all related expenses have been reconciled, you can determine the amount owed by reviewing the balances in Property Mgmt Funds Payable and Property Mgmt Funds Receivable on your balance sheet. These two account balances should match. See the example below for how to record this transaction:

Example Transaction

You, as the property management company, have a balance of $9,000 in the Property Mgmt Funds Receivable account for amounts owed by the owner, Jona Bombard, for the listing at 989 Athens Way. You are now ready to pay yourself this amount from the trust account.

First, initiate the bank transfer from the Trust Bank Account to your operating account through your financial institution. Once the transfer has posted, record the outgoing transaction from the Trust Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $9,000 | Jona Bombard – 989 Athens Way | |

| 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable | $9,000 | Jona Bombard – 989 Athens Way |

Next, record the incoming transaction to your Operating Bank Account with the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $9,000 | Jona Bombard – 989 Athens Way | |

| 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable | $9,000 | Jona Bombard – 989 Athens Way |

Detailed instructions for Xero

1. Find the amount to pay

Assuming you’ve reconciled any expenses, the amount that needs to be paid can be found in the balance sheet under “23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable” or “12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable” (both of these account balances should match).

2. Transfer the amount from the trust bank account to your operations account

Once you’ve verified the amount, go to your bank and transfer this amount from the trust bank account to your business operations bank account.

3. Reconcile the Trust bank feed transaction in Xero

| Contact | Account | Tracking Category |

|---|---|---|

| Your Property Mgmt Company | 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable | Jona Bombard – 989 Athens Way |

- Set the Contact to the name of your property management company

- Set 100% of the amount to account code “23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable”

- Set the Tracking Category to “Owner Name – Listing”

4. Reconcile the Operations bank feed transaction in Xero

| Contact | Account | Tracking Category |

|---|---|---|

| Your Property Mgmt Company | 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable | Jona Bombard – 989 Athens Way |

- Set the Contact to the name of your property management company

- Set 100% of the amount to account code “12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable”

- Set the Tracking Category to “Owner Name – Listing”

Paying Owners from the Trust Account

Owner funds have accumulated over the previous month, and it’s now time to pay owners from the trust account. The total amount owed to each owner can be found on the balance sheet under “Owner Funds”. You can filter these balances by selecting the appropriate tracking category for each owner. See the example below for how to record the payout transaction:

Example Transaction

You, as the manager of Airbnb properties, are holding $23,500 in trust for the owner, Jona Bombard, for the listing at 989 Athens Way. Based on your month-end reporting, you are now ready to disburse these funds to the owner.

First, send the payment to the owner via bank transfer, ACH, check, or another approved method. Once the transfer has posted, record the outgoing transaction from the Trust Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $23,500 | Jona Bombard – 989 Athens Way | |

| 23600 – Trust Account Liability – Owner Funds – Less Owner Payouts | $23,500 | Jona Bombard – 989 Athens Way |

Detailed instructions for Xero

1. Find the amount to pay

The amount that needs to be paid to each owner can be found in the balance sheet. Filtering the balance sheet by the tracking category for each owner, look up the sum of all amounts under all “Trust Account Liability – Owner Funds” accounts.

2. Create Bill for each Owner

| Contact | Account | Description | Tracking Category |

|---|---|---|---|

| Kim Sorreno | 23600 – Trust Account Liability – Owner Funds – Less Owner Payouts | “Owner Payout” | Jona Bombard – 989 Athens Way |

- Set Contact to the name of the owner

- Set Account to “23600 – Trust Account Liability – Owner Funds – Less Owner Payouts”

- Set Description to “Owner Payout”

- Set Amount to the sum of all amounts under all “Trust Account Liability – Owner Funds” accounts for the specific owner.

- Set Tracking Category to “Owner Name – Listing”

3. Transfer the amount from the trust bank account to the owner

Once you’ve verified the amount, send the money from the trust account to the owner via bank transfer, ACH, check or other means.

4. Reconcile trust bank account amount with bill

Reconcile the bill with the trust bank feed in Xero

Paying Expenses on Behalf of Owners Directly from the Trust Account

Your management agreement likely includes a clause allowing you to purchase items on behalf of the owner—such as repairs or maintenance—using the funds held for them in the trust account. Before making any purchase, you must first confirm that the owner has sufficient funds available in their Owner Funds Reserved account. If the balance is insufficient, you must allocate additional funds to this account before proceeding; otherwise, you risk commingling funds belonging to different owners, which is a serious trust-accounting violation.

Assuming the owner has adequate funds, the following example shows how to record the transaction:

Example Transaction

The owner, Jona Bombard, has requested that you purchase a new water heater using the funds held in the trust account for her property at 989 Athens Way. The total cost of the purchase and installation is $2,330, which will be paid to a professional maintenance company.

First, pay the maintenance company from the Trust Bank Account using your chosen method, bank transfer, ACH, check, or another option. Once the payment has posted, record the outgoing transaction from the Trust Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $2,330 | Jona Bombard – 989 Athens Way | |

| 23310 – Trust Account Liability – Owner Funds – Owner Funds Reserved | $2,330 | Jona Bombard – 989 Athens Way |

Detailed instructions for Xero

1. Check how much exists in the Owner Funds Reserved account for the owner

Make sure the owner has enough funds allocated in their Owner Funds Reserved account, which you can find in the balance sheet filtered by tracking category. If there’s not enough funds, you’ll need to allocate funds into this account from another trust liability account, else you’ll run the risk of commingling funds of other owners within the trust account.

2. Create Bill

| Contact | Account | Description | Tracking Category |

|---|---|---|---|

| Name of Vendor | 23310 – Trust Account Liability – Owner Funds – Owner Funds Reserved | “Owner Expense: <description>” | Jona Bombard – 989 Athens Way |

- Set the Contact of the bill to the vendor you’re paying

- Create as many lines as necessary, but set the Account codes to “23310 – Trust Account Liability – Owner Funds – Owner Funds Reserved”

- Set a detailed description for each line, starting with “Owner Expense: ”

- Set the tracking category for each line to “Owner Name – Listing”

3. Transfer the amount from the trust bank account to the vendor

Send the money to the vendor via bank transfer, ACH, check or other means.

4. Reconcile trust bank account amount with bill

Reconcile the bill with the trust bank feed in Xero

Paying Expenses on Behalf of Owners from your Operations Bank Account

There may be situations where you purchase items for an owner’s property using your property management operating bank account rather than the trust account. This is especially common for smaller maintenance issues that require immediate attention. In these cases, you can reimburse yourself after month-end when you prepare your reports and transfer the appropriate funds from the trust account. Here’s how to record this type of transaction:

Example

A property owned by Jona Bombard requires a bathroom faucet replacement by a professional plumber. The service costs $400 and must be completed quickly, as guests are arriving later the same day.

Begin by paying the plumbing company from your Operations Bank Account using bank transfer, ACH, check, or another payment method. Once the payment has posted, record the outgoing transaction from your Operations Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $400 | Jona Bombard – 989 Athens Way | |

| 7XXXX – Billable Expenses (Expense) | $400 | Jona Bombard – 989 Athens Way |

Next, make an entry for the amounts owed to you from the the trust account so it’ll be included at the next month-end payout. Optionally, include a 20% markup for coordinating and funding the service. Use the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 23500 – Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt | $480 | Jona Bombard – 989 Athens Way | |

| 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable | $480 | Jona Bombard – 989 Athens Way | |

| 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable | $480 | Jona Bombard – 989 Athens Way | |

| 4XXXX – Billable Expenses Income (Revenue) | $480 | Jona Bombard – 989 Athens Way |

When the next month-end payout occurs, the amount of $480 will be included in the “12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable” and “23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable”.

Detailed instructions for Xero

1. After paying the service provider, categorize and reconcile the transaction in your operations bank feed

| Contact | Account | Description | Amount | Tracking Category |

|---|---|---|---|---|

| Plumber Pro | 7XXXX – Billable Expenses (Expense) | “Billable Expense: Bathroom Faucet Replaced” | $400 | Jona Bombard – 989 Athens Way |

2. Create a Zero-Balance Bill

Set the contact of the bill to the name of your property management company. In each line, include a 20% markup ($480 total)

| Account | Amount | Description | Tracking Category |

|---|---|---|---|

| 23500 – Trust Account Liability – Owner Funds – Less Amounts Due to Property Mgmt | -$480 | “Billable Expense: Bathroom Faucet Replaced” | Jona Bombard – 989 Athens Way |

| 23140 – Trust Account Liability – Property Mgmt Funds – Property Mgmt Funds Payable | $480 | “Billable Expense: Bathroom Faucet Replaced” | Jona Bombard – 989 Athens Way |

| 12200 – Trust Account Asset – Property Mgmt Funds – Property Mgmt Funds Receivable | -$480 | “Billable Expense: Bathroom Faucet Replaced” | Jona Bombard – 989 Athens Way |

| 4XXXX – Billable Expenses Income (Revenue) | $480 | “Billable Expense: Bathroom Faucet Replaced” | Jona Bombard – 989 Athens Way |

Remitting Taxes from the Trust Account

In many jurisdictions, Airbnb collects taxes and remits them directly to the local tax authorities on the owner’s behalf. However, you may choose to receive these taxes from Airbnb and remit them yourself. If you’re using Tallybreeze, the Custom Taxes line item in our presets will automatically allocate the appropriate tax amounts for each reservation. This section explains how to remit those collected taxes to the local tax authorities.

Example

The owner, Jona Bombard, has a listing at 989 Athens Way for which the Airbnb listing is configured to collect custom taxes on all reservations. In Tallybreeze, these tax amounts are allocated to the Custom Taxes Payable account. After running a balance sheet report for this listing in Xero, you determine that $1,180 is owed in transient occupancy taxes, reflected under “23380 – Trust Account Liability – Owner Funds – Airbnb Collections – Custom Taxes Payable”.

To remit this amount, first send the payment to the appropriate tax authority via bank transfer, ACH, check, or another approved method. Once the payment has posted, record the outgoing transaction from the Trust Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $1,180 | Jona Bombard – 989 Athens Way | |

| 23380 – Trust Account Liability – Owner Funds – Airbnb Collections – Custom Taxes Payable | $1,180 | Jona Bombard – 989 Athens Way |

Detailed instructions for Xero

1. Check how much exists in the Custom Taxes Payable account for the owner

2. Create Bill

| Contact | Category | Description | Tracking Category |

|---|---|---|---|

| Name of Tax Authority | 23380 – Trust Account Liability – Owner Funds – Airbnb Collections – Custom Taxes Payable | “Taxes Paid: Name of Tax Authority” | Jona Bombard – 989 Athens Way |

- Set the Contact of the bill to the the name of the tax authority

- Set the Product/Service to Custom Taxes Payable

- Set a detailed description, starting with “Taxes: ” and describe the tax

- Set the tracking category to “Owner Name – Listing”

3. Transfer the amount from the trust bank account to the tax authority

Send the money to the tax authority via bank transfer, ACH, check or other means.

4. Reconcile trust bank account amount with bill

Reconcile the bill with the trust bank feed in Xero

Generate Monthly Reports & Owner Statements in Xero

Once all Airbnb data has been accurately imported into Xero and any remaining expenses have been reconciled, you can easily generate clear, professional owner statements and reports each month.

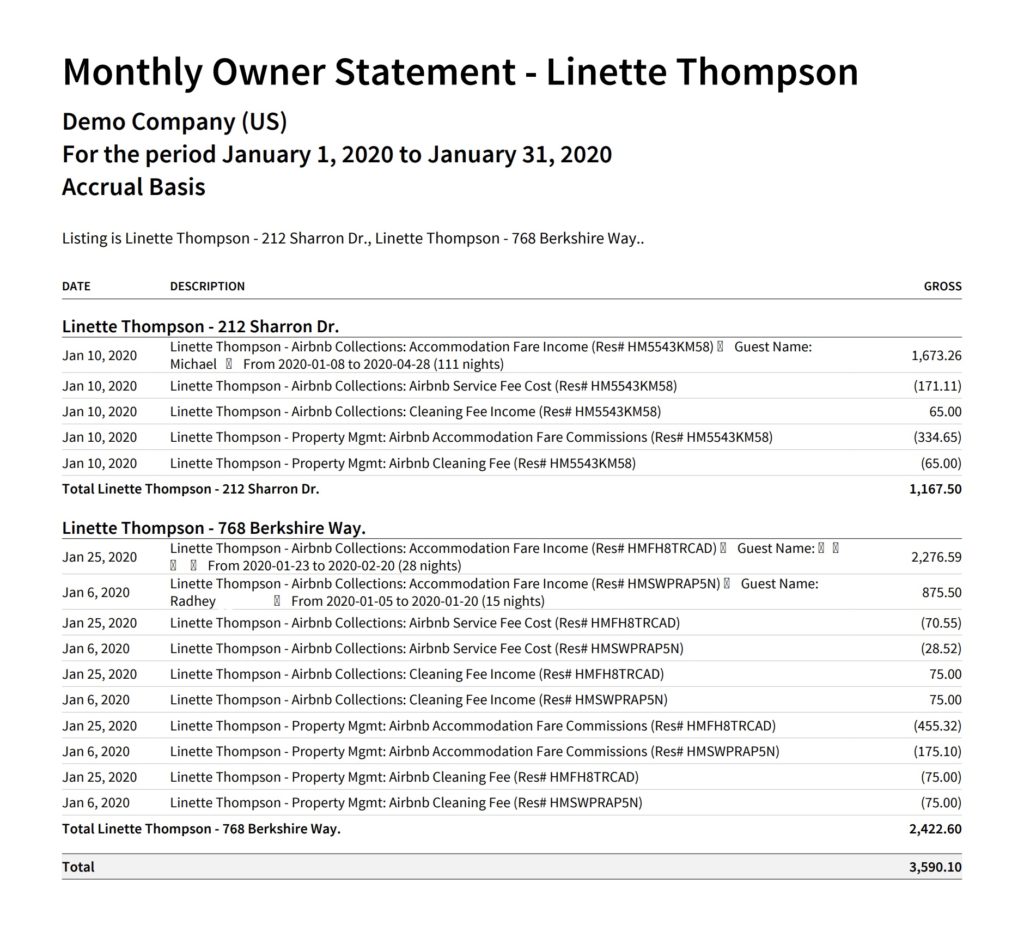

Monthly Owner Statement by Listing

This statement can be sent to owners each month. It is grouped by tracking category, allowing you to present activity on a per-listing, per-owner basis. This format gives owners a clear view of their earnings for each property, along with all movements in and out of the trust account. Each line generated by Tallybreeze includes the reservation code and a detailed description of the transaction. A final grand total owed to the owner appears at the bottom.

In the example below, we’re displaying an owner statement for a single owner, Linette Thompson:

Quick Setup Steps

Here’s how to create the above Owner Statement by Listing in Xero:

- In Xero, go to Reports, select “Account Transactions”.

- Under Accounts, select all accounts starting with text “Trust Account Liability – Owner Funds”.

- Select the report period (perhaps the previous month).

- Under Columns, uncheck all columns except keep “Date”, “Description” and “Gross”.

- Under Grouping/Summarizing, select “Group by” and “Listing” or whichever you named for your tracking category that identifies your listings.

- Under Filter, only select the listings under the owner you want to report for.

- Sort by Description.

- Customize the title as needed.

- Select “Update”

From here this statement can be saved as a custom report and re-used every month for the owner.

Conclusion

This guide serves as a comprehensive resource for automating the management of client funds with the highest level of integrity. Even when not legally required, following trust accounting standards elevates the professionalism of your property management operations and strengthens how clients perceive your services. Proper trust accounting of Airbnb listings, as outlined in this article, delivers the transparency owners expect – an essential foundation for earning their trust and gaining referrals.

Because this level of transparency can be complex and time-consuming to maintain, automation becomes indispensable. We hope this guide has provided you with valuable insight and practical tools to support you as you continue to grow and refine your property management firm.

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out :

- Xero for Airbnb Listings: Property Management without Trust Accounting

- Xero for Airbnb Listings: Co-Host Accounting

- Xero for Airbnb Listings: Rental Arbitrage Accounting

- Xero for Airbnb Listings: Investment Property Accounting

- All Xero Templates for Airbnb

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

5 thoughts on “Xero for Airbnb Listings: Trust Accounting for Property Managers”

Comments are closed.