Who should read this guide?

This guide is designed for real estate investors who own one or more properties on Airbnb and use Xero for their accounting. Listing investment properties on Airbnb is a business model in which an operator builds equity more quickly than with traditional long-term rentals in exchange for the added overhead of operating a short-term rental. This model performs best in markets where short-term rental income significantly exceeds local long-term rental rates.

Because of this, accounting decisions become especially important. Staying on top of your numbers can make a meaningful difference in managing and growing your operation. In this guide, we focus on how to properly account for all income received through Airbnb from an investor’s perspective, including how to automate your Airbnb revenue accounting using Xero.

USING QUICKBOOKS? READ THIS ARTICLE INSTEAD

NOTE: This guide only covers Airbnb revenue accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Accounting for Costs to Operate Airbnb Listings: Best Chart of Accounts

Table of Contents

Here’s what you’ll get from this guide:

- Xero Chart of Accounts Template for Investment Properties on Airbnb

- How to Automate Accounting for Airbnb Listings

- Execute Common Transaction Workflows in Xero

- Generate Monthly Reports in Xero

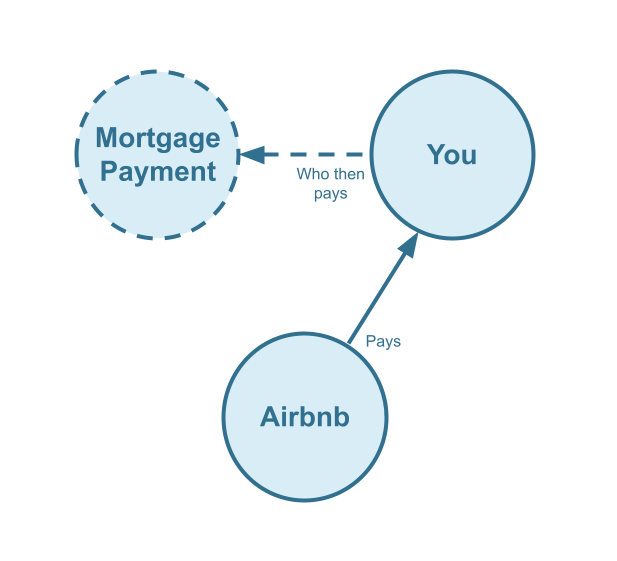

Cash Flow Diagram

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- Xero for Airbnb Listings: Rental Arbitrage Accounting

- Xero for Airbnb Listings: Co-Host Accounting

- Xero for Airbnb Listings: Property Management without Trust Accounting

- Xero for Airbnb Listings: Trust Accounting for Property Managers

- All Xero Templates for Airbnb

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

Xero Chart of Accounts Template for Investment Properties on Airbnb

Here we’ll describe our Xero chart of accounts template for Airbnb income in great detail:

Account Codes

| No. | Account | Type |

|---|---|---|

| 24200 | Rental Liability – Airbnb Custom Taxes Payable | Liability |

| 42100 | Rental Revenue – Airbnb Income – Accommodation Fare | Revenue |

| 42200 | Rental Revenue – Airbnb Income – Cleaning Fee | Revenue |

| 42300 | Rental Revenue – Airbnb Income – Resolution Adjustment | Revenue |

| 42400 | Rental Revenue – Airbnb Refund – Accommodation Fare | Revenue |

| 42500 | Rental Revenue – Airbnb Refund – Cleaning Fee | Revenue |

| 42600 | Rental Revenue – Airbnb Refund – Resolution Adjustment | Revenue |

| 51100 | Rental Costs – Airbnb Service Fee | Cost of Service |

| 61100 | Airbnb Tax Withholdings | Expense |

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Accounting for Costs to Operate Airbnb Listings: Best Chart of Accounts

Detailed Explanation of Accounts

To learn more about each specific account code, we’ve listed each definition here:

Rental Liabilities

24200 – Rental Liability – Airbnb Custom Taxes Payable – This represents all Custom Taxes collected from Airbnb and payable to a tax authority.

Rental Revenues

42100 – Rental Revenue – Airbnb Income – Accommodation Fare – This account tracks the accommodation fare portion of each Airbnb reservation. The accommodation fare is equal to the number of nights multiplied by the average nightly rate of each reservation.

42200 – Rental Revenue – Airbnb Income – Cleaning Fee – This account tracks the cleaning fee portion of each Airbnb reservation.

42300 – Rental Revenue – Airbnb Income – Resolution Adjustment – This account tracks any resolution adjustments collected from Airbnb.

42400 – Rental Revenue – Airbnb Refund – Accommodation Fare – This account tracks accommodation fare refunds executed by Airbnb.

42500 – Rental Revenue – Airbnb Refund – Cleaning Fee – This account tracks cleaning fee refunds executed by Airbnb.

42600 – Rental Revenue – Airbnb Refund – Resolution Adjustment – This account tracks resolution adjustment refunds executed by Airbnb.

Rental Costs

51100 – Rental Costs – Airbnb Service Fee – This account tracks service fee costs from Airbnb for each reservation, which is subtracted from the income.

61100 – Airbnb Tax Withholdings – This account tracks any taxes withheld by Airbnb for income tax obligations. This is very rare and usually due to the Airbnb account holder lacking tax identification information. Ideally, this account should not contain any balance and is seldom (if ever) used. To avoid income tax withholdings from Airbnb, be sure to update your Airbnb account with your tax identification information and verify your account.

Accounts not included in this template

For the scope of this guide, we’re mainly focused on Airbnb revenue recognition. It is important to point out that our template does not include many general accounts. We also make reference to some accounts not included in this particular template, which we’ll list here:

- 11000 – Airbnb Payment Clearing Account – This account is created by Tallybreeze but is not included in this template in particular. This account is used to apply payments to Airbnb invoices upon the day the Airbnb reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Airbnb. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in Xero.

- 1XXXX – Operations Bank Account – This is your business operations bank account set up with your financial institution. It’s a cash asset account to facilitate your Airbnb Arbitrage day-to-day business operations.

- 2XXXX – Mortgage Principal – This account is a long-term liability account used to track the mortgage loan principal owed.

- 7XXXX – Mortgage Interest – This account is an expense account and is used to track the interest payments of the mortgage loan.

Quick Setup Steps

Here’s how to import the above chart of accounts template. The chart of accounts discussed in this article can be imported into Xero automatically using Tallybreeze’s setup tools. Here’s how to access this utility…

- If you haven’t already, Sign Up to Tallybreeze. It includes free use of this template.

- Once registered, go to the Connections manager in Tallybreeze. Connect your Airbnb account, connect your Xero account and then create a connection between the two.

- Within the Connection settings, select “Set Up Xero”

How to Automate Accounting for Airbnb Listings

Airbnb can become a significant source of revenue for many property investors. With Tallybreeze, automating the reconciliation of your Airbnb reservations in Xero has never been easier or more convenient. In the following section, we’ll walk through how to automate revenue accounting for investment properties on Airbnb, including chart of accounts setup and preset configuration.

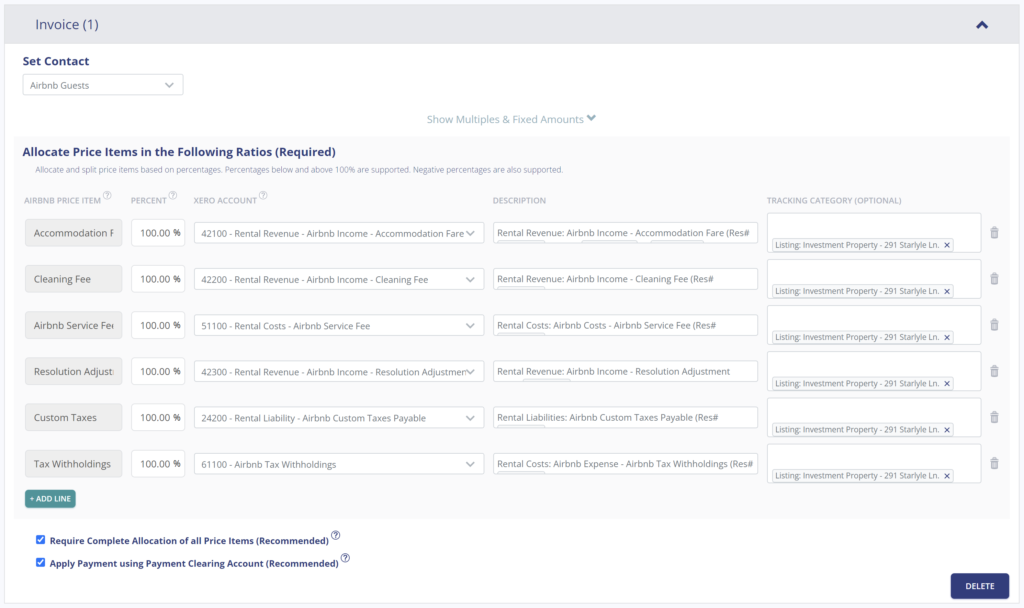

Tallybreeze Listing Presets

The Tallybreeze team has developed an easy-to-use interface to help you manage your Airbnb listings. Once connected to Xero, the system guides you through setting up accounting rules for each listing so everything can be optimized quickly and efficiently.

Explanation of Preset Lines

In this business model, all amounts collected through Airbnb belong to you. This includes the accommodation fare, cleaning fee, Airbnb service fee (as a subtraction), any resolution adjustments, optional custom taxes, and any applicable tax withholdings.

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 100% | 42100 – Rental Revenue – Airbnb Income – Accommodation Fare |

| Cleaning Fee | 100% | 42200 – Rental Revenue – Airbnb Income – Cleaning Fee |

| Airbnb Service Fee | 100% | 51100 – Rental Costs – Airbnb Service Fee |

| Resolution Adjustment | 100% | 42300 – Rental Revenue – Airbnb Income – Resolution Adjustment |

| Custom Taxes | 100% | 24200 – Rental Liability – Airbnb Custom Taxes Payable |

| Tax Withholdings | 100% | 61100 – Airbnb Tax Withholdings |

Example Reservation

Let’s say you have Tallybreeze configured for this listing using the preset settings above. Now imagine Airbnb sends a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $1348

- Cleaning Fee: $185

- Airbnb Service Fee: -$54

- Airbnb Transient Occupancy Taxes: $211

- Reservation Total: $1690

Tallybreeze records all income received from Airbnb, separating each price item accordingly. The total amount due from Airbnb for this reservation is $1,690, which is posted to the Airbnb Payment Clearing Account and later reconciled against the corresponding bank deposit.

| Account | Debit | Credit |

|---|---|---|

| 42100 – Rental Revenue – Airbnb Income – Accommodation Fare | $1348 | |

| 42200 – Rental Revenue – Airbnb Income – Cleaning Fee | $185 | |

| 51100 – Rental Costs – Airbnb Service Fee | $54 | |

| 24200 – Rental Liability – Airbnb Custom Taxes Payable | $211 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $1690 |

On the date the reservation payout is deposited by Airbnb into your Operations Bank Account (typically 3–5 days later), a bank rule in Xero can automatically reconcile the amount back to the Airbnb Payment Clearing Account:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Operations Bank Account | $1690 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $1690 |

Set Invoice Customer & Class Categories

The most efficient way to manage your guests in Xero is to create a general contact for all guest-related transactions, typically named “Airbnb Guests.” However, if you prefer, you can have Tallybreeze assign each individual guest as the contact. In that case, we’ll create a separate contact in Xero for each guest and set them as the customer on the invoice for their reservation.

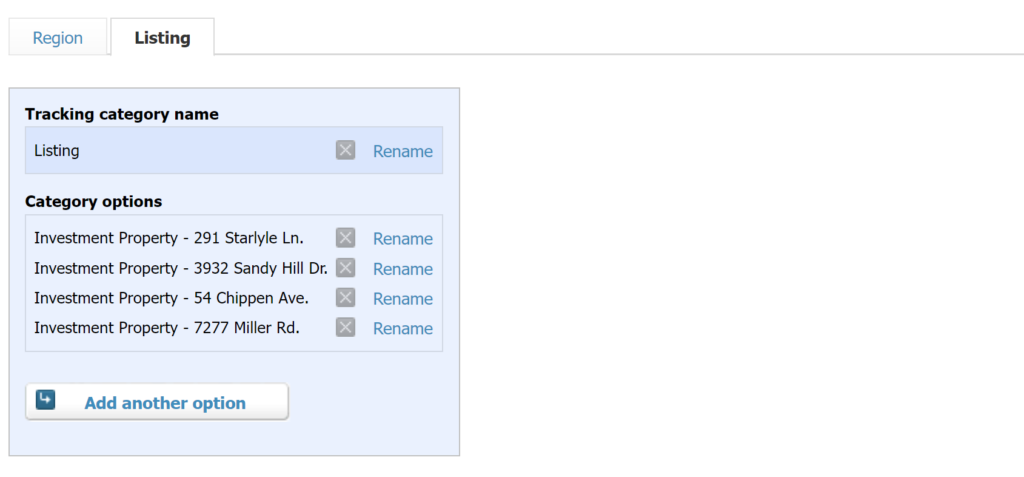

If you have multiple listings, it’s also helpful to create a tracking category in Xero for each property. Many users name their tracking categories “Investment Property – ” followed by the listing’s address. Here’s an example:

Automate Additional Bills & Invoices (Optional)

With Tallybreeze, you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill for each reservation to automate amounts payable to a tax authority.

- Create a bill for each reservation to automate amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice for each reservation to automate amounts receivable by any third party.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze’s presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Execute Common Transaction Workflows in Xero

In this section, we explore the key nuances of Airbnb investment property transactions. Below are the most common workflows used by investors:

Making a Mortgage Payment

A common transaction to account for is your mortgage payment, which includes both principal and interest.

Example Transaction

As the Airbnb investor, you are making a monthly mortgage payment of $2,134, of which $421 is interest. This payment relates to the property at 741 Peacock Ave and is processed as a recurring bank transaction. Once the transfer posts and clears, reconcile the outgoing transaction from your Operations Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $2,134 | Investment – 741 Peacock Ave | |

| 2XXXX – Mortgage Principal | $1,713 | Investment – 741 Peacock Ave | |

| 7XXXX – Mortgage Interest | $421 | Investment – 741 Peacock Ave |

Detailed instructions for Xero

1. Create a Recurring Bill

| Contact | Account | Description | Amount | Tracking Category |

|---|---|---|---|---|

| Mortgage Company | 2XXXX – Mortgage Principal | “Mortgage Principal Payment” | $1,713 | Investment – 741 Peacock Ave |

| Mortgage Company | 7XXXX – Mortgage Interest | “Mortgage Interest Payment” | $421 | Investment – 741 Peacock Ave |

2. Pay the Bill

Pay the Bill directly in Xero or reconcile the Bill against the payment made in your bank feed.

Remitting Custom Taxes

In many regions, Airbnb collects transient occupancy taxes and remits them directly to the local tax authorities on your behalf. If that applies to you, this section does not apply. However, many Airbnb investors choose to receive these taxes from Airbnb and pay the tax authority themselves, giving them greater control over their funds.

If you take this approach and use Tallybreeze, the Custom Taxes line item in your presets will automatically account for the taxes collected. All you need to do is remit the amount owed to your tax authority based on what has been collected. We’ll walk through that process here:

Example

The listing at 741 Peacock Ave is configured in Airbnb to collect custom taxes for all reservations. In Tallybreeze, these amounts are allocated to “24200 – Rental Liability: Airbnb Custom Taxes Payable”. After running a balance sheet report for this listing in Xero, you determine that $350 is owed in transient occupancy taxes.

You’ll first need to remit this payment to the tax authority, whether by bank transfer, ACH, check, or another method. Once the payment posts and clears, record the outgoing transaction from your Operations Bank Account using the following entry:

| Debit | Credit | Tracking Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $350 | Investment – 741 Peacock Ave | |

| 24200 – Rental Liability – Airbnb Custom Taxes Payable | $350 | Investment – 741 Peacock Ave |

Detailed instructions for Xero

1. Check how much exists in the Custom Taxes Payable account for the property

The amount that needs to be paid to the tax authority can be found in the balance sheet. Filtering the balance sheet by the tracking category for each listing, look up the total amount under “24200 – Rental Liability: Airbnb Custom Taxes Payable”.

2. Create Bill

| Contact | Account | Description | Tracking Category |

|---|---|---|---|

| Tax Authority | 24200 – Rental Liability – Airbnb Custom Taxes Payable | “Taxes Paid: 11% City TOT” | Investment – 741 Peacock Ave |

- Set the contact of the bill to the name of the tax authority

- Set the Account to “24200 – Rental Liability – Airbnb Custom Taxes Payable”

- Set a detailed description, starting with “Taxes: ” and describe the tax

- Set the tracking category to the listing

3. Transfer the amount from your operations bank account to the tax authority

Send the money via bank transfer, ACH, check or other means.

4. Reconcile operations bank account statement line amount with bill

Reconcile the bill with the bank feed in Xero

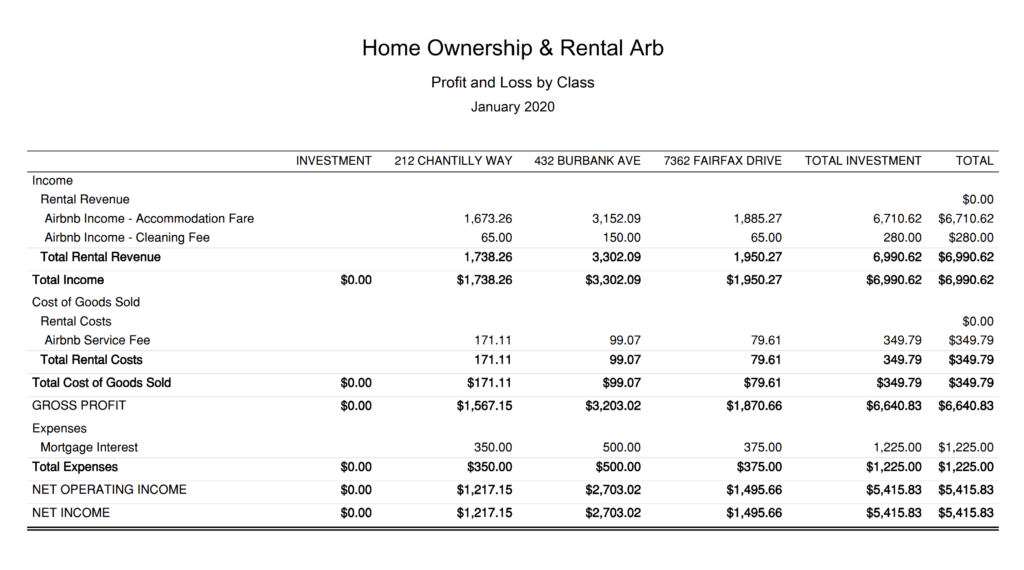

Generate Monthly Reports in Xero

Now that your reservation data is automatically processed from Airbnb and accurately synced into Xero, you can generate clean, insightful monthly reports for your Airbnb property investments. After reconciling your expenses, you’ll be able to review each listing’s performance in detail.

Profit & Loss by Listing

This report is ideal for comparing the performance of your Airbnb listings. You can find it under the “Reports” section in Xero and selecting “Profit and Loss”. From there, edit the layout to add columns and assign each column to a specific listing you want to track. This report will display the profitability of each listing, making it easy to identify your top performers.

Conclusion

In the right market and location, Airbnb can be a powerful vehicle for building equity and accelerating returns on your investment properties. By using a clear and structured accounting approach, paired with the automation capabilities of tools like Tallybreeze, you gain full visibility into your financial performance and can make smarter, data-driven decisions.

We hope this guide has helped you better understand how to manage and optimize your Airbnb property investment accounting in Xero. As you continue to grow your real estate portfolio, these practices will support cleaner books, clearer insights, and more confident operations.

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out:

- Xero for Airbnb Listings: Rental Arbitrage Accounting

- Xero for Airbnb Listings: Co-Host Accounting

- Xero for Airbnb Listings: Property Management without Trust Accounting

- Xero for Airbnb Listings: Trust Accounting for Property Managers

- All Xero Templates for Airbnb

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

6 thoughts on “Xero for Airbnb Listings: Investment Property Accounting”

Comments are closed.