Who should read this guide?

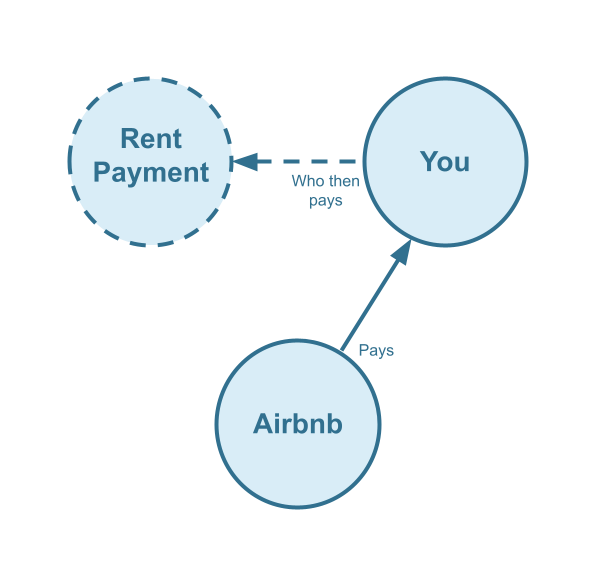

This guide is designed for operators running rental arbitrage listings on Airbnb who manage their accounting in QuickBooks. Rental arbitrage through Airbnb is a business model in which an operator signs a master lease with a property owner and then subleases the property to guests on Airbnb. This strategy works best in markets where short-term rental revenue exceeds local long-term rental rates.

Because profitability depends heavily on accurate financial tracking, having an automated accounting system is essential. In this guide, you’ll learn how to set up, implement, and automate accounting for the rental arbitrage business model for Airbnb using QuickBooks.

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Accounting for Costs to Operate Airbnb Listings: Best Chart of Accounts

About Rental Arbitrage on Airbnb

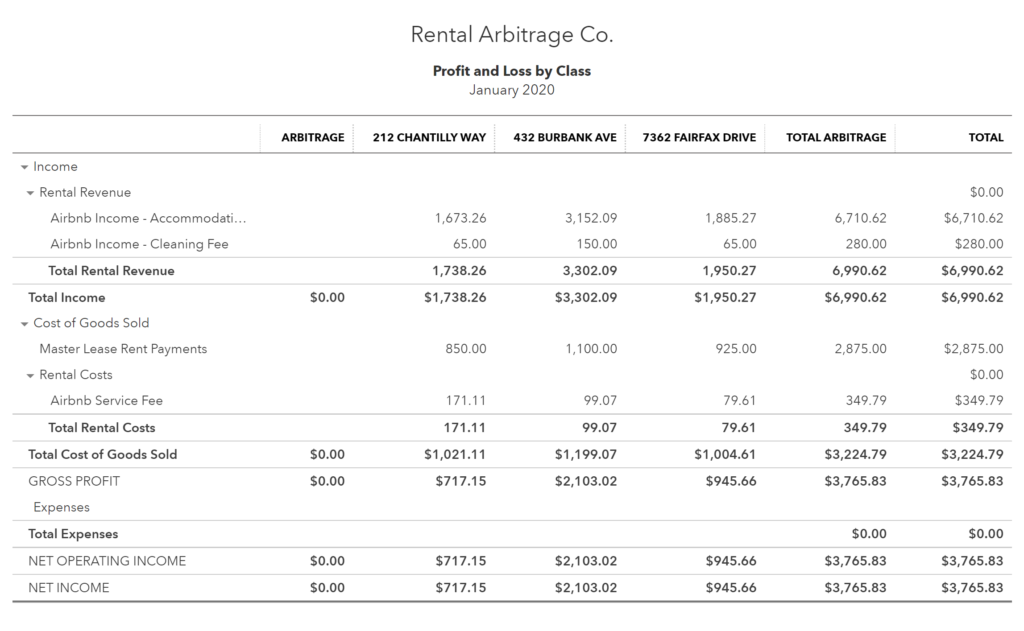

The rental arbitrage business model offers several compelling advantages. Depending heavily on location, operators in markets with strong short-term rental demand and relatively low long-term rental rates can achieve gross profit margins of 30–50% or more, significantly higher than the typical 15–20% earned through commission-based property management. Because the operator holds a master lease and has legal possession of the property, they also gain greater control over daily operations. There is minimal owner involvement, no obligation to provide monthly financial reports, and the operator retains substantial freedom to run the business without actually owning the property.

However, this model does come with notable risks. The lease itself becomes a fixed obligation, which can be problematic during market downturns or periods of reduced travel. If revenues decline, profit margins shrink while rental payments remain constant. Even in strong markets, rent increases (unless properly negotiated in the master lease) can erode profitability over time. Operators are also typically responsible for furnishing the property, leading to higher upfront costs compared to traditional property managers, who often share or pass those expenses to the property owner.

Table of Contents

Here’s what you’ll get from this guide:

- QuickBooks Chart of Accounts Template for Rental Arbitrage on Airbnb

- How to Automate Accounting for Airbnb Listings

- Execute Common Transaction Workflows in QuickBooks

- Generate Monthly Reports in QuickBooks

Cash Flow Diagram

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- QuickBooks for Airbnb Listings: Co-Host Accounting

- QuickBooks for Airbnb Listings: Investment Property Accounting

- QuickBooks for Airbnb Listings: Trust Accounting for Property Managers

- QuickBooks for Airbnb Listings: Property Management without Trust Accounting

- All QuickBooks Templates for Airbnb

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

QuickBooks Chart of Accounts Template for Rental Arbitrage on Airbnb

In this section, we’ll go over the details of our QuickBooks chart of accounts template for the Airbnb rental arbitrage business model:

Account Codes

| No. | Account | Type |

|---|---|---|

| 24000 | Rental Liability | Liability |

| 24200 | Rental Liability: Airbnb Custom Taxes Payable | Liability |

| 42000 | Rental Revenue | Revenue |

| 42100 | Rental Revenue: Airbnb Income – Accommodation Fare | Revenue |

| 42200 | Rental Revenue: Airbnb Income – Cleaning Fee | Revenue |

| 42300 | Rental Revenue: Airbnb Income – Resolution Adjustment | Revenue |

| 42400 | Rental Revenue: Airbnb Refund – Accommodation Fare | Revenue |

| 42500 | Rental Revenue: Airbnb Refund – Cleaning Fee | Revenue |

| 42600 | Rental Revenue: Airbnb Refund – Resolution Adjustment | Revenue |

| 51000 | Rental Costs | Cost of Service |

| 51100 | Rental Costs: Airbnb Service Fee | Cost of Service |

| 61100 | Airbnb Tax Withholdings | Expense |

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Accounting for Costs to Operate Airbnb Listings: Best Chart of Accounts

Detailed Explanation of Accounts

To learn more about each specific account code, we’ve listed each definition here:

Rental Liability

24000 – Rental Liability – This is a parent account with child accounts that account for rental liabilities.

24200 – Rental Liability: Airbnb Custom Taxes Payable – This represents all Custom Taxes collected from Airbnb and payable to a tax authority.

Rental Revenue

42000 – Rental Revenue – This is a parent account with child accounts that account for rental revenue.

42100 – Rental Revenue: Airbnb Income – Accommodation Fare – This account tracks the accommodation fare portion of each Airbnb reservation. The accommodation fare is equal to the number of nights multiplied by the average nightly rate of each reservation.

42200 – Rental Revenue: Airbnb Income – Cleaning Fee – This account tracks the cleaning fee portion of each Airbnb reservation.

42300 – Rental Revenue: Airbnb Income – Resolution Adjustment – This account tracks any resolution adjustments collected from Airbnb.

42400 – Rental Revenue:Airbnb Refund – Accommodation Fare – This account tracks accommodation fare refunds executed by Airbnb.

42500 – Rental Revenue: Airbnb Refund – Cleaning Fee – This account tracks cleaning fee refunds executed by Airbnb.

42600 – Rental Revenue: Airbnb Refund – Resolution Adjustment – This account tracks resolution adjustment refunds executed by Airbnb.

Rental Costs

51000 – Rental Costs – This is a parent account with child accounts that account for rental costs.

51100 – Rental Costs: Airbnb Service Fee – This account tracks service fee costs from Airbnb for each reservation, which is subtracted from the income.

61100 – Airbnb Tax Withholdings – This account tracks any taxes withheld by Airbnb for income tax obligations. This is very rare and usually due to the Airbnb account holder lacking tax identification information. Ideally, this account should not contain any balance and is seldom (if ever) used. To avoid income tax withholdings from Airbnb, be sure to update your Airbnb account with your tax identification information and verify your account.

Accounts not included in this template

For the scope of this guide, we’re mainly focused on Airbnb revenue recognition. It is important to point out that our template does not include many general accounts. We also make reference to some accounts not included in this particular template, which we’ll list here:

- 11000 – Airbnb Payment Clearing Account – This account is created by Tallybreeze but is not included in this template in particular. This account is used to apply payments to Airbnb invoices upon the day the Airbnb reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Airbnb. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in QuickBooks.

- 1XXXX – Operations Bank Account – This is your business operations bank account set up with your financial institution. It’s a cash asset account to facilitate your rental arbitrage day-to-day business operations.

- 5XXXX – Master Lease Rent Payments – This is an account used to track the amounts you’re paying to owners for master leases.

- 4XXXX – Billable Expenses Income – This is a general account for capturing income received for the payment of billable expenses by owners, which may include a markup.

- 7XXXX – Billable Expenses – This is a general account for tracking billable expenses for any owners.

Quick Setup Steps

Here’s how to import the above chart of accounts template. The chart of accounts discussed in this article can be imported into QuickBooks automatically using Tallybreeze’s setup tools. Here’s how to access this utility…

- If you haven’t already, Sign Up to Tallybreeze. It includes free use of this template.

- Once registered, go to the Connections manager in Tallybreeze. Connect your Airbnb account, connect your QuickBooks Online account and then create a connection between the two.

- Within the Connection settings, select “Set Up QuickBooks”

- Select your business model from the drop-down list at the top and select “Import Template to QuickBooks”.

How to Automate Accounting for Airbnb Listings

With Tallybreeze, you can automate your rental arbitrage accounting for Airbnb listings and stay focused on growing a more profitable business. In this section, we’ll walk through how to use the preset settings specifically designed for syncing reservations under the rental arbitrage model. These presets rely on the chart of accounts outlined earlier in the guide.

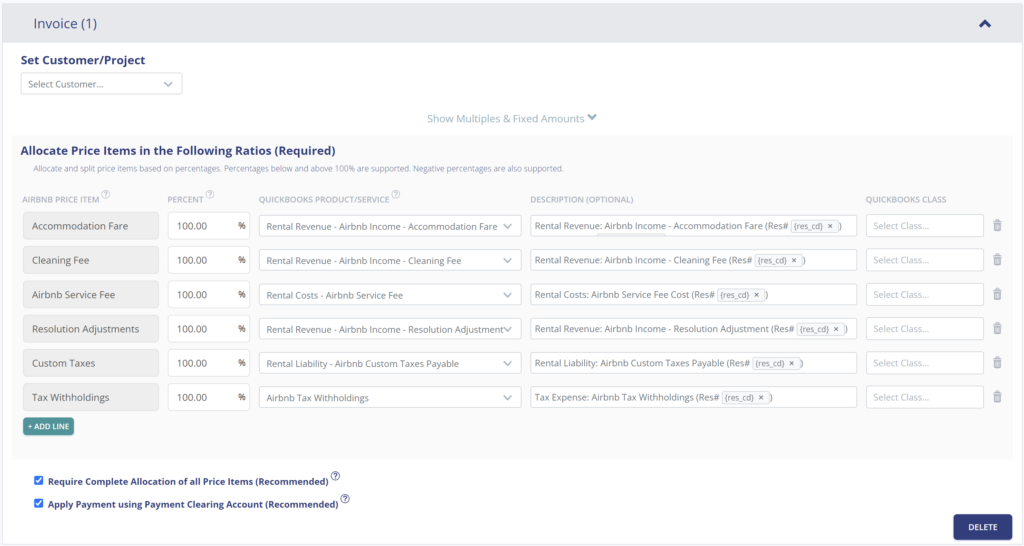

Tallybreeze Listing Presets

Once your Airbnb and QuickBooks accounts are connected, Tallybreeze will guide you through setting up the accounting rules for your rental arbitrage listings on Airbnb. You can review and adjust these presets as needed before enabling them for automation.

Explanation of Preset Lines

100% of all income received from Airbnb is allocated as revenue to the business. This includes the accommodation fare, cleaning fee, Airbnb service fee (deducted), resolution adjustments, optional custom taxes, and any applicable tax withholdings.

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 100% | 42100 – Rental Revenue: Airbnb Income – Accommodation Fare |

| Cleaning Fee | 100% | 42200 – Rental Revenue: Airbnb Income – Cleaning Fee |

| Airbnb Service Fee | 100% | 51100 – Rental Costs: Airbnb Service Fee |

| Resolution Adjustment | 100% | 42300 – Rental Revenue: Airbnb Income – Resolution Adjustment |

| Custom Taxes | 100% | 24200 – Rental Liability: Airbnb Custom Taxes Payable |

| Tax Withholdings | 100% | 61100 – Airbnb Tax Withholdings |

Example Reservation

Let’s assume you’ve set up Tallybreeze for this listing using the preset settings above. Now imagine Airbnb issues a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $2000

- Cleaning Fee: $300

- Airbnb Service Fee: -$60

- Airbnb Transient Occupancy Taxes: $200

- Reservation Total: $2440

Tallybreeze records all income received from Airbnb, separating each price item individually. The total amount owed by Airbnb for this reservation is $2,440, which is posted to the Airbnb Payment Clearing Account. This amount will later be reconciled against the corresponding bank deposit.

| Account | Debit | Credit |

|---|---|---|

| 42100 – Rental Revenue: Airbnb Income – Accommodation Fare | $2000 | |

| 42200 – Rental Revenue: Airbnb Income – Cleaning Fee | $300 | |

| 51100 – Rental Costs: Airbnb Service Fee | $60 | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $200 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

Finally, when the reservation payout is deposited into your Operations Bank Account (typically 3–5 days later), a bank rule in QuickBooks can automatically match and reconcile the amount to the Airbnb Payment Clearing Account:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Operations Bank Account | $2440 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

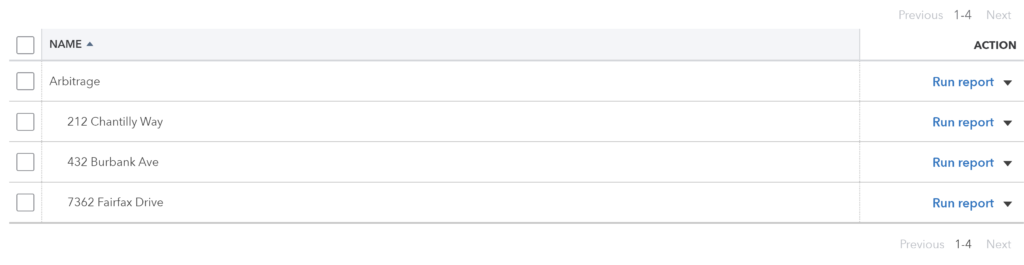

Set Invoice Customer & Class Categories

The simplest way to manage your guests in QuickBooks is to create a general customer for all Airbnb reservations. We recommend naming it “Airbnb Guests.” However, if you prefer to track each guest individually, you can configure Tallybreeze to set the actual guest as the customer. In that case, Tallybreeze will create a new customer record in QuickBooks for each guest and assign them to the invoice for their reservation.

If you operate more than one listing, you should also create a separate class category in QuickBooks for each property.. many users name the class using the property address. We also recommend placing each of these listing classes under a parent class called “Arbitrage.” Click below to see an example:

Automate Additional Bills & Invoices (Optional)

With Tallybreeze, you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set amounts payable to a tax authority for each reservation.

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze’s presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

- Select your business model from the options.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Execute Common Transaction Workflows in QuickBooks

The following is a list of common transaction workflows for rental arbitrage of Airbnb listings in QuickBooks.

Paying Rent to Owners

Owners receive a fixed rent each month, which means it’s easy to create a recurring payment. Each rent payment can be reconciled to “5XXXX – Master Lease Rent Payments”.

Example Transaction

As the rental arbitrage operator, you pay the owner, Claudia Smith, $2,000 in monthly rent for the property at 212 Chantilly Way. This payment is made through a recurring bank transaction each month. Once the transaction posts, you can reconcile the outgoing amount from your Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $2,000 | Arbitrage: 212 Chantilly Way | |

| 5XXXX – Master Lease Rent Payments (Cost) | $2,000 | Arbitrage: 212 Chantilly Way |

Detailed instructions for QuickBooks Online

1. Create a Recurring Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Claudia Smith | 5XXXX – Master Lease Rent Payments | “Master Lease Rent Payment” | Arbitrage: 212 Chantilly Way |

- Set Vendor to the name of the owner “Claudi Smith”

- Set Category to “5XXXX – Master Lease Rent Payments”

- Set Description to “Master Lease Rent Payment”

- Set Amount to the rent amount

- Set Class to the listing address

2. Pay the Bill

Pay the Bill directly in QuickBooks or reconcile the Bill against the payment made in your bank feed.

Paying Expenses on Behalf of Owners

If you need to purchase maintenance items and pay for them quickly, you may use funds directly from your Operations Bank Account. If your rental agreement allows, you can then deduct those expenses from the next month’s rent payment to the property owner(s).

Example

A property owned by Claudia Smith requires a bathroom faucet replacement by a professional plumber. The service costs $200 and must be handled quickly, as guests are checking in later that day. You also apply a 20% markup for allocating funds and coordinating the repair on the owner’s behalf.

First, pay the plumbing company from your Operations Bank Account using a bank transfer, ACH, check, Venmo, or another acceptable method. Once the transaction posts, record the outgoing payment from your Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $200 | Arbitrage: 212 Chantilly Way | |

| 7XXXX – Billable Expenses (Expense) | $200 | Arbitrage: 212 Chantilly Way |

When your next rent payment is due ($2,000), subtract the amount you billed for the repair plus the 20% markup. This results in a reduced payment of $1,760 ($2,000 − $240 = $1,760). Once the transaction posts, record the outgoing payment from your Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $1760 | Arbitrage: 212 Chantilly Way | |

| 5XXXX – Master Lease Rent Payments (Cost) | $2000 | Arbitrage: 212 Chantilly Way | |

| 4XXXX – Billable Expenses Income (Revenue) | $240 | Arbitrage: 212 Chantilly Way |

Detailed instructions for QuickBooks Online

1. After paying the service provider, categorize and reconcile the transaction in your operations bank feed

| Payee | Category | Description | Amount | Class |

|---|---|---|---|---|

| Plumber Pro | 7XXXX – Billable Expenses (Expense) | “Billable Expense: Bathroom Faucet Replaced” | $200 | Arbitrage: 212 Chantilly Way |

2. Subtract amount when making the next rent payment and reconcile as follows

Rent is $2,000. When making the payment, subtract the repair cost plus the 20% markup, resulting in a reduced payment of $1,760 ($2,000 − $240 = $1,760). Once the transaction posts, record the outgoing payment from your Operations Bank Account using the following entry:

| Payee | Category | Description | Amount | Class |

|---|---|---|---|---|

| Claudia Smith (Owner) | 5XXXX – Master Lease Rent Payments (Cost) | “Rent Payment for 212 Chantilly Way” | $2000 | Arbitrage: 212 Chantilly Way |

| Claudia Smith (Owner) | 4XXXX – Billable Expenses Income (Revenue) | “Billable Expense: Bathroom Faucet Replaced” | -$240 | Arbitrage: 212 Chantilly Way |

Remitting Custom Taxes

In most areas, Airbnb collects taxes and remits them to the tax authority on your behalf. If that applies to you, you can skip this section. However, if you prefer greater control over your funds, you can choose to receive custom taxes directly from Airbnb and remit them yourself. When you take this approach, Tallybreeze will automatically allocate the custom taxes for each reservation using the Custom Taxes line in the preset. You can then pay the tax authority following the example below.

Example

The listing at 462 Atlas Way is configured in Airbnb to collect custom taxes for all reservations. In Tallybreeze, these amounts are posted to “24200 – Rental Liability: Airbnb Custom Taxes Payable.” After running a Balance Sheet report for this listing in QuickBooks, you determine that $200 is owed in transient occupancy taxes.

To remit this amount, send your payment to the tax authority via bank transfer, ACH, check, or another accepted method. Once the transaction posts, record the outgoing payment from your Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $200 | Arbitrage: 212 Chantilly Way | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $200 | Arbitrage: 212 Chantilly Way |

Detailed instructions for QuickBooks Online

1. Check how much exists in the Custom Taxes Payable account for the owner

The amount that needs to be paid to the tax authority can be found in the balance sheet. Filtering the balance sheet by the class for each listing, look up the total amount under “24200 – Rental Liability: Airbnb Custom Taxes Payable”.

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Tax Authority | 24200 – Rental Liability: Airbnb Custom Taxes Payable | “Taxes Paid: 11% City TOT” | Arbitrage: 212 Chantilly Way |

- Set the vendor of the bill to the name of the tax authority

- Set the Product/Service to “24200 – Rental Liability: Airbnb Custom Taxes Payable”

- Set a detailed description, starting with “Taxes: ” and describe the tax

- Set the class to the listing

3. Transfer the amount from your operations bank account to the tax authority

Send the money via bank transfer, ACH, check or other means.

4. Reconcile operations bank account statement line amount with bill

Reconcile the bill with the bank feed in QuickBooks

Generate Monthly Reports in QuickBooks

With Tallybreeze, Airbnb reservation data flows into QuickBooks automatically and accurately. Once your expenses are recorded, you can generate clear, professional monthly reports with ease and review the performance of each listing without any hassle.

Profit & Loss by Class

This report is ideal for comparing the performance of your Airbnb rental arbitrage listings side by side. In QuickBooks, you can find it by navigating to Reports in the left menu and selecting Profit and Loss by Class. This report highlights the profitability of each listing, making it easy to see which properties are performing best.

Conclusion

Rental arbitrage on Airbnb can be an incredibly lucrative business model, requiring relatively modest upfront costs while giving you full control over your accommodation brand. But success depends on keeping a close eye on your numbers.. especially as you scale, acquire additional properties, and negotiate with current or prospective landlords. Consistently monitoring your listings and recording accurate financials is essential to understanding how well your operations are performing, which in turn helps you make the most profitable decisions.

A streamlined accounting system offers the transparency needed to run a strong, data-driven business.. something we hope this guide has helped you achieve as you build your firm.

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out:

- QuickBooks for Airbnb Listings: Co-Host Accounting

- QuickBooks for Airbnb Listings: Investment Property Accounting

- QuickBooks for Airbnb Listings: Trust Accounting for Property Managers

- QuickBooks for Airbnb Listings: Property Management without Trust Accounting

- All QuickBooks Templates for Airbnb

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

7 thoughts on “QuickBooks for Airbnb Listings: Rental Arbitrage Accounting”

Comments are closed.